A Calm After the Shock: Markets React to Trump’s Statement

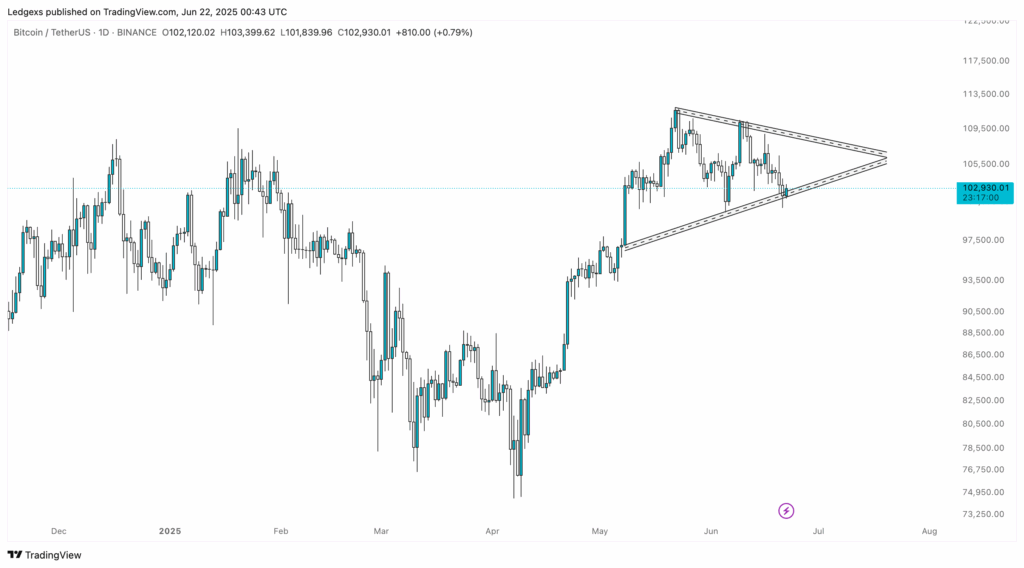

On June 22, Bitcoin closed the day inside a tightening symmetrical wedge formation, refusing to break down amid global tensions. Earlier in the week, markets wobbled following reports of U.S. military action against Iranian assets. However, a surprise peace-focused message from Donald Trump late Sunday appeared to ease fears, helping BTC maintain its technical structure.

“Peace through strength, always. But escalation is not the answer,” Trump wrote on Truth Social, drawing headlines across financial and political spheres. The statement came hours after military sources confirmed precision strikes in response to Iranian cyberactivity.

Bitcoin, which had started to retreat from the $106K area, rebounded near $101K and closed the daily candle at $102,337, right along wedge support.

Bitcoin Technical View: Compression Within the Wedge

Bitcoin’s daily chart clearly shows a tightening price structure. After forming higher lows since April and lower highs since early June, price action has narrowed into a symmetrical triangle. This often signals a large breakout — though the direction remains unknown.

- Upper Resistance: Around $106,000

- Key Support: $101,000–$102,000 (Where Daily Candle Closed)

- Breakout Levels: Above $106K (Bullish) or below $98K (Bearish)

For now, Bitcoin is respecting the wedge. Traders are closely watching for either a breakout confirmation or a breakdown beneath the lower trendline.

Macro Factors: Geopolitics and Digital Gold

Bitcoin’s recent resilience may be attributed not only to technical setups but also to its emerging role as a geopolitical hedge. As tensions flare, some investors are turning to BTC as a hedge against fiat devaluation and military instability.

Trump’s decision to de-escalate comes at a time when global markets are already on edge due to inflation, ETF volatility, and interest rate speculation. In that context, BTC’s reaction — measured, but not panicked — could reflect increasing maturity in crypto markets.

What to Watch This Week

- Wedge Break Confirmation — A daily close outside the wedge with volume will guide short-term direction.

- U.S. Fed Commentary — Any dovish signals could support further upside.

- Iran-U.S. Developments — Renewed tension could turn risk sentiment bearish fast.

Final Thoughts: Balance Between Fear and Opportunity

Bitcoin remains within a tightly coiled technical structure, shaped by weeks of market uncertainty. Yet the reaction to Trump’s peace message shows that BTC is no longer a mere speculative asset — it’s now behaving as a macro barometer. As the wedge narrows, the breakout may not just be technical. It could also reflect the market’s broader response to a world that feels more unstable by the day.